Confidence in a currency determines its future. If people believe in the currency, they will store the generated value of their life’s work in terms of that currency. They will place the money received for their labor into a bank for future consumption. They expect the “value” to be protected until such a time they need the money to purchase goods and services. They also expect interest payments for the privilege of the safe use of their money until they need it. These interest payments should insure that value is retained into the future. The primary function of money is to store value. Only as a store of value can it then be used as a medium of exchange. This has been the underlying view of German monetary policy since WWII.

The Eurozone must tighten its monetary policy to survive. Austerity measures are required by those countries who have attempted to sustain their lifestyle by borrowing. Germany is dictating controls over those countries in trouble and this equates to a loss of sovereignty for them. This policy forces the affected countries into recession with a strong potential of depression. Greece is already there. Their stock market is down 90% from its all time high. The big question is will those countries bring the rest of Europe into a severe recession and will it spread to the rest of the globe.

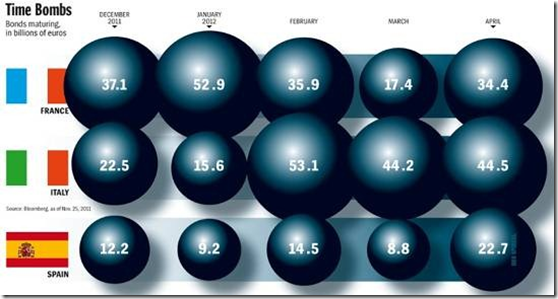

2012 will see one to three nations exit the Euro. You should expect a revolution to occur in at least one country which will need to be managed by those in power. There are no established rules for exiting the Euro. January 1 is its 10th anniversary and it appears that it will not survive another decade. As a country exits the Euro, it will nationalize its own currency and preexisting sovereign debt is subject to default. This is where the financial exposure is for the rest of the globe. Once default occurs, holders of that debt must claim the loss on their financial statements thus exposing the weakness that has been hidden by lax accounting rules. This could have a cascading effect on the global financial market and worries central banks.

There is a high risk of recession in 2012. We do not have the normal pre-conditions for a recession. The high level of debt that has prevailed and a cleansing process is needed to remove this high level of debt. The balance sheets of those who are holding that debt will take a major hit. I am concerned that the instability of the Euro will adversely affect the U.S. financial markets and produce additional “MF Global’s”.