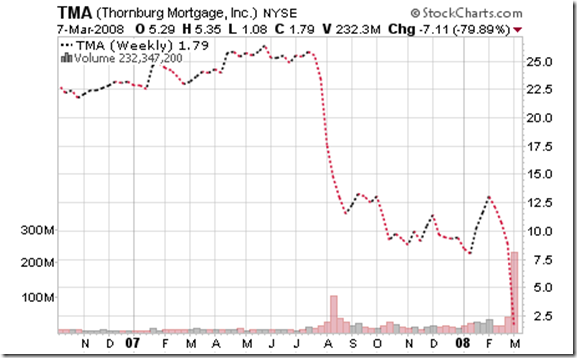

How would you like to be one of those who purchased the following stock in January of 2007 at $25.00 only to see it now worth $1.79?

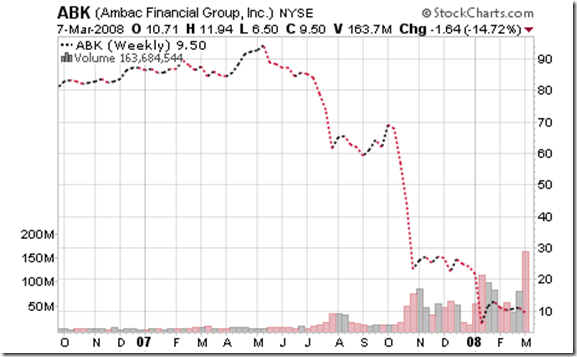

Thornburg Mortgage is unable to meet margin call requirements by its lenders on $610 million. Once the smoke clears this mortgage company will probably be out of business. Another stock, Ambac Financial Group (ABK), is also in serious trouble. Ambac is down 90% from its recent high. However, Ambac’s problems have a greater repercussion than Thornburg. Ambac is a primary insurer of financial instruments. With this insurance "wrap", many securities were rated as "investment" grade securities. This means that pension funds and other conservative investors could own these securities. "Investment grade" is deemed to be highly secure. However, if the guarantee by the insurer (Ambac) becomes worthless, then the "rating" of the security may fall below investment grade. If that happens, then investors may have to liquidate their position and thus create a reduced demand for these securities. The end result is the securities’ price is drastically cut. Other holders of the security must then show unrealized losses on their balance sheets. With additional losses, the holder must begin liquidating some of the assets to maintain financial stability. This is a downward spiral. Ambac is currenty insuring about $524 Billion of outstanding debt. See: http://www.washingtonpost.com/wp-dyn/content/article/2008/03/07/AR2008030700657.html

The financial institutions and the Federal Reserve are intimately aware of this issue. They will find a solution to further prop up Ambac or the securities Ambac insures. With a much lower stock price and performance, AMBAC will have difficulty raising enough capital to stay in business. It did raise $1.5 Billion but I suspect that amount will have a high "burn" rate in the coming months as more debt securities heads south and Ambac is forced to pay out claims.

Banks face "systemic margin call," $325 billion hit: JPM

NEW YORK (Reuters) – Wall Street banks are facing a "systemic margin call" that may deplete banks of $325 billion of capital due to deteriorating subprime U.S. mortgages, JPMorgan Chase & Co, said in a report late on Friday. See: http://www.reuters.com/article/ousiv/idUSN0832645120080308

Remember, when a bank loses money on a loan, the loss goes directly to the bottom line and forces the bank to contract its loans and investments. If banks are leveraged 10 to 1 against their capital, this puts $3.25 Trillion into play. Hopefully this isn’t the domino that causes all of the other financial dominos to fall.

Could it be that Our Heavenly Father is beginning the cleansing cycle?