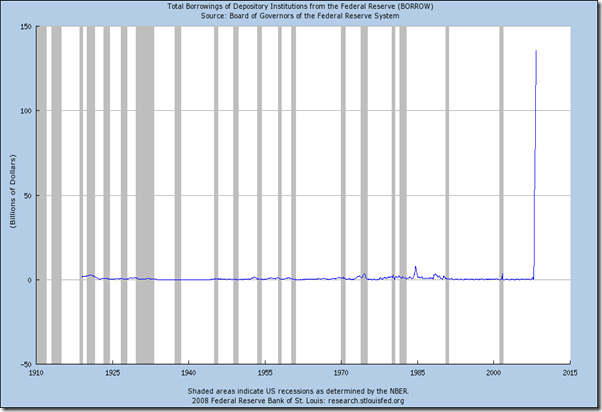

We can see the sun and the wind has subsided, the ocean is still, all is calm, or is it? The following graph illustrates the seriousness of the problem:

That hyperbolic blue line is the total borrowings from the Fed, now at about $140 Billion. The gray sections are the recessions with the 1930’s having the greatest recession (depression). It looks like we may be due for one if cycles hold true. We are at risk of another credit meltdown, one even larger than the subprime crisis. Gold and silver are at nice "buy" levels for those who believe that inflation is running at a greater level than reported by the government.

The New York Attorney General is preparing to settle with the ratings agencies who continued to "look the other way" while the mortgage bankers were placing trash as AAA rated securities into the system. See:http://www.bloomberg.com/apps/news?pid=20601087&sid=aGcUiy5dBBEs&refer=home The settlement appears to be a slap on the hand and a "wink". Once again the investing public is dealing with "unequal weights and measures". How long will the Lord God Almighty allow this to continue? It would appear that the entire financial system is being set up for a huge fall. Investors have been replace by gamblers who have stacked the deck against the average investor. Hedge funds have been allowed to leverage their bets up to 300 to 1. The average person cannot leverage anything. Such leverage cannot stand a serious loss.

There is approximately $180 Trillion in financial assets and there is about $2 Trillion in gold worldwide. $1 Trillion is held by Central Banks and the other is held by the public. Can you imagine the price of gold if just a small percentage held in financial assets were to shift to gold as a protection against inflation? $3,000 per ounce is not unrealistic. You can also see that when currency was tied to gold, inflation could not occur. Once the link was removed, Central Banks could inflate their currencies in the name of expansion. This will help us understand why a load of bread was once 30 cents. A disconnect from gold evoked a policy of inherent inflation in the globe’s goods and services.

China is concerned about a dollar crisis within 5 years. See: http://www.reuters.com/article/reutersEdge/idUSL0221460620080603 I believe we are within 36 months. I have targeted 1/11/2011 as a watch date. Oil is a world currency. It has been denominated in U.S. Dollars but that is changing. Other countries are beginning to move away from dollar denominated oil exchanges (oil bourse[commodity exchange]). If the U.S. Dollar were not in a crisis and losing value relative to other currencies, there would not be a move away from dollar denominated oil exchanges. China’s $1,600,000,000,000 USD is losing value. I expect the value to decrease by another 30% or about $500 Billion. What can they do to protect themselves? They can buy hard assets which will not lose value relative to the dollar.

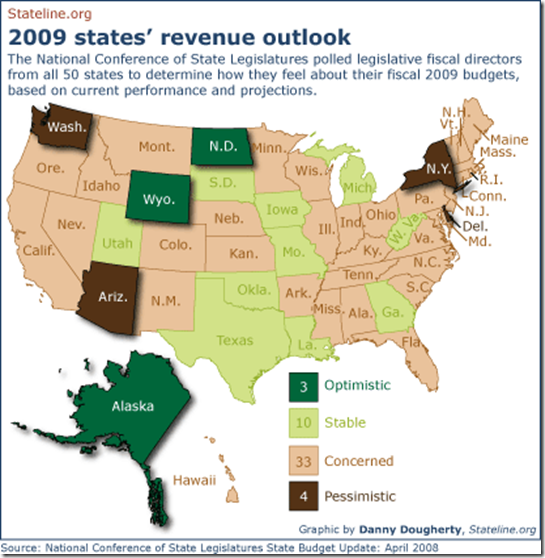

All of the issues point to a highly complex economic challenge to keep the wheels on the wagon. State revenues are falling. Some municipalities have filed bankruptcy. The following graph provides a state by state outlook:

My advice: Simplify your life. Get rid of things you don’t need. Pursue love, not things. Eliminate debt. Gold and silver are financial insurance.