Everyone is enjoying the breather in high gasoline prices. Do not be lulled to sleep, these prices will rise again with a vengeance. The de-leveraging phenomenon hit all commodities with a sudden wave of sellers who were required to raise cash. The fundamentals of peak oil have not changed in the last 36 months.

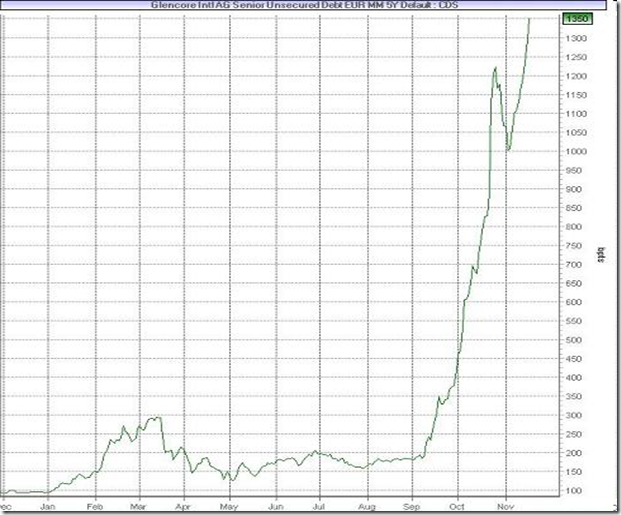

Who is at the center of this oil de-leveraging? It may include Glencore International AG, a privately held company owned by its management and employees. Headquartered in Baar, Switzerland. The following unverified graph provides a view of the exposure of Glencore:

I have not fully verified this data but if it is accurate, Glencore has a serious problem. With the unwillingness of banks to extend credit, even large companies may not survive. Total Assets were US$ 60.0 billion and Total Glencore Shareholders’ Funds were US$ 15.7 billion at 31 December 2007. It will be interesting to see Glencore’s 2008 numbers. According to an Australian Public Radio report, "Glencore’s history reads like a spy novel". The company was founded as Marc Rich & Co. AG in 1974 by billionaire commodity trader Marc Rich, who was charged with tax evasion and illegal business dealings with Iran in the U.S., but pardoned by President Bill Clinton in 2001. In 1993 and 1994, Rich sold all of his majority share in Marc Rich & Co. AG back to the company. The enterprise, renamed Glencore, is now owned and run by his former associates, including former Glencore CEO Willy Strothotte and present CEO Ivan Glasenberg. In 2005, proceeds from an oil sale to Glencore were seized as fraudulent, in an investigation into corruption in the Republic of Congo. See: http://en.wikipedia.org/wiki/Glencore

From my personal experience, the Swiss tend to be hush, hush about financial issues of their own industries. If Glencore was on the wrong side of credit default swaps, we will soon find out.

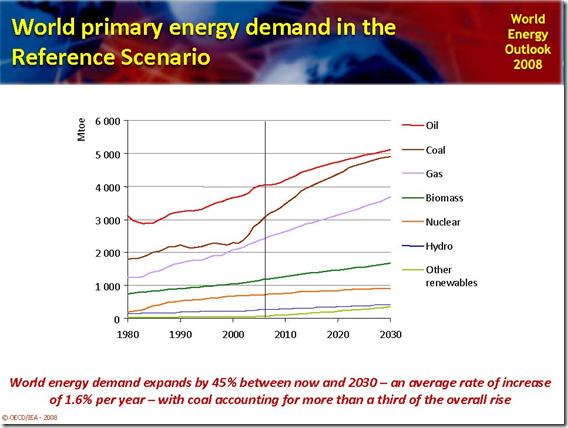

How many of us have simply parked or sold our cars and travel by foot or bicycle? Once you have a taste of mobility, you never want to go back. This is the reality of China and India. Their demand continues to rise. The following graph from the IEA depicts the demand growth of energy:

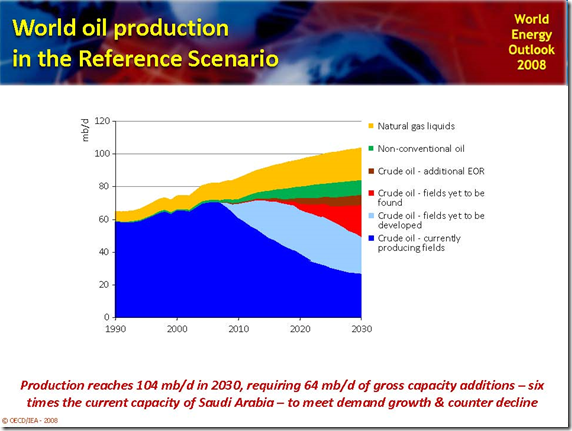

The following graph depicts the needed supply growth over the same period:

The IEA expects the following:

– A serious decline in currently producing fields

– A leveling off of total crude oil production (optimistic)

– A growth in natural gas liquids to take up the slack.

This will require 64 million barrels per day of gross capacity additions- 6 times the current capacity of Saudi Arabia.

$300 oil is on the horizon…

Will Our Heavenly Father release the revelation of free energy? Only when Love prevails. Until then, brace yourself for a wild ride.