Bill Clinton coined the phrase in the 1992 Presidential Election- “It’s the economy, stupid!” and stayed focus on that issue which helped win him the election. Now there is a greater issue at hand- the world economic system with the U.S. Dollar as the reserve currency. For decades the U.S. Dollar has been the medium of exchange for global transactions thus creating a consistent demand. Times are a changin’! The U.S. supremacy is coming into question and those in power are attempting to keep the wheels on the wagon by expanding power without oversight.

The following interview was conducted during the Financial Services Subcommittee on Oversight and Investigations hearing of May 5, 2009. Rep. Alan Grayson asks the Federal Reserve Inspector General about the oversight responsibilities:

This interview makes us wonder just who is in charge? Further, as we all know that the Federal Reserve is a private entity, how can there be no accounting to the people of the United States whose money is being spent? The country may be becoming “too big to survive” instead of too big to fail.

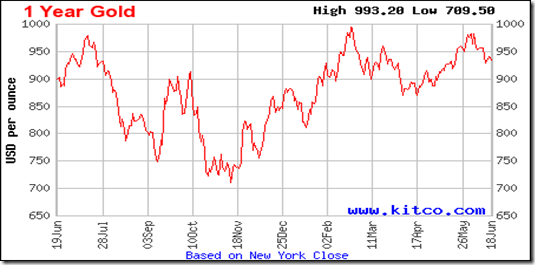

A primary battle front is the price of gold in U.S. Dollars. The following graph shows an interesting technical formation:

Notice from Mid February thru the current session that there is a reverse head & shoulders pattern forming. This is a power pattern if and when it is confirmed. The following is a historical example of this pattern:

Notice that once the price moved above the “neckline”, the stock headed upward. For gold, the neckline is $1,000 and if it penetrates that price with strong volume, technicians expect a strong price move to $1,300 and that does not bode well for the U.S. Dollar. This is why the battle is on between central government intervention and the investment community. Over the last nine years, gold has yielded 16.4% return on investment but you hear very little in the press about that performance. Gold is the “canary in the mine” for the fate of the U.S. Dollar. $5,000 gold is no longer an unreasonable peak price.

Have you noticed how many U.S. officials are making trips to China these days? China has a huge investment in Dollar holdings and must be reassured that the dollar isn’t going to tank.

At a recent trip to China by Timothy Geithner:

“Chinese assets are very safe,” Geithner said in response to a question after a speech at Peking University, where he studied Chinese as a student in the 1980s.

His answer drew loud laughter from his student audience, reflecting skepticism in China about the wisdom of a developing country accumulating a vast stockpile of foreign reserves instead of spending the money to raise living standards at home. See: http://finance.yahoo.com/news/Geithner-tells-China-its-rb-15396905.html?.v=2

Gold acts as “insurance” against a declining U.S. Dollar and there is not really too much anyone can do about the decline except to try to slow the descent.

In a recent speech, economist John Taylor from Stanford told the Atlanta Fed that with the current spending policies in place, the U.S. Government will need to increase taxes of the American people. A 60 percent tax increase across the board would be required. Otherwise to cut the debt being created, an inflation rate of 10% for 10 years will be required. http://www.stanford.edu/~johntayl/Systemic_Risk_and_the_Role_of_Government-May_12_2009.pdf

Take your pick!

You can better understand why the BRIC countries are signing bilateral trade agreements thus removing the U.S. Dollar from the mix. BRIC or BRICs is an acronym that refers to the fast-growing developing economies of Brazil, Russia, India, and China. Russia is the only country with sufficient internal problems that may slow down the move away from the use of U.S. Dollars to settle trade among those countries.

History tells us the every country whose currency was used as the world’s reserve currency and became a debtor nation to the extent of the U.S., their economy ultimately collapsed.