The cascading waterfall effect of a stock price chart is triggered by an inflection point in the markets. Everyone expects the US Dollar to decline but it’s anybody’s guess on how and when. The hope is an orderly decline over multiple years yet the global markets cannot be government controlled just as an elephant cannot really be controlled by a mere man with a stick. The elephant allows his “master” to have his way until the elephant simply decides to do something different. Governments attempt to paint an acceptable picture to the markets so as to control their direction and response. This will only work until the markets smell “blood”.

Banks continue to act as hedge funds and speculate in the market and at the same time provide great resistance through the Washington Lobbying machine to keep restrictions from forcing them to once again be a banking industry that serve the common man.

Gold is a hedge against the mismanagement of the “economic system”, not a hedge against inflation. When politicians continue to make decisions promoting self-interest, they undermine the productivity of the country and push it towards destruction. As the confidence in the future growth of true productivity and capacity wanes, gold becomes the store of value to protect against the mismanagement. Once you are convinced the policies will result in the destruction of infrastructure, personal savings, and reinvestment, you must discipline yourself to sit on the sidelines and wait for the ship to sink while guarding your wealth from being swept into the fracas.

The fundamentals of stock investing do not take into account of an outside force impacting the stock. For instance, the oil embargo impacted energy sensitive stocks but could not be accounted for in the fundamental analysis of the stock. The recent volcanic eruption costing the airline industry $2 Billion in revenues could not be foreseen in the decision to acquire transportation stocks. The volatility of world events are forcing investors to add “insurance” to their portfolio in terms of precious metals and related mining shares.

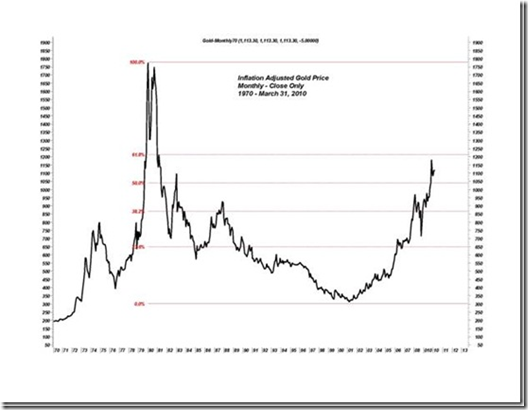

Below is an inflation adjusted graph of the price of gold. The point of this graph is that gold has not yet hit the record $850 achieved in 1979. It would have to surpass $1775 to break the inflation adjusted record.

During the time of the Carter Administration, high interest rates solved the problem that parallels today’s environment. However, never in the history of this country has the debt burden outlook been so severe as it is now. It all but insures that Obama will be a one-term president. He has few options that are palatable among voters. An orderly depreciation of the US Dollar is the optimum solution but the markets and our creditors are not going to sit on the sidelines while their investment in US Dollars is depreciated away. At some point, a big player will head to the exit with others fighting their way to the door. The last one out will be the ultimate loser and it may just be the U.S. citizenry. If this Black Swan event happens, %5,000 Gold will be on the radar…