The International Energy Agency is projecting global oil demand at 116 million barrels per day by 2030. Currently the global demand is approximately 88 million barrels per day. China and India will continue to increase their demand for oil. India is now manufacturing at $2,500 car. As its exports grow, oil consumption will grow. China is expected to overtake the U.S. in light duty vehicle sales by 2016-2017. This alone will add about 10 million barrels of new oil demand by 2030.

Population:

With over 2.3 billion people and growing, China and India’s income growth will fuel auto sales, infrastructure spending, and commodity prices. Sand, cement, copper, and other commodities are at record prices due to the infrastructure needs of these countries. China is building new roads, gasoline stations, pipelines, and other infrastructure to support this increase in transportation requirements.

Peak Oil:

The U.S. 48 states experienced "peak oil" in 1970. Overall production has been in decline ever since. The North Slope of Alaska experienced peak oil in 1989. Mexico’s Cantarell field (the 2nd largest field in the world) experienced peak oil in 2005 and has declined by 41% since. OPEC countries have reported the same reserves for decades which is clearly not true. Therefore we must assume that their fields are in decline as well. The largest oil discovery in the world has been in production for over 60 years (Ghawar field in Saudi Arabia was discovered in 1948). Considering the current decline curve of existing production, we will need to find over 60 million barrels of new oil by 2030. I do not expect this to happen. 17% of global crude supply comes from 10 super-giant oil fields. The following table provides this breakdown:

|

Giant Oil Field Ghawar (Saudi Arabia) Cantarell (Mexico) Burgan (Kuwait) Daqing (China) Kirkuk (Iraq) Rumalia (Iraq) Shaybah (Saudi Arabia) Safaniyah (Saudi Arabia) Zuluf (Saudi Arabia) U.L. Zakum (U.A.E.)

Source: World’s Giant Oilfields by Matthew R. Simmons, 2001 White Paper ≠ Current Estimates “Best Guesses” |

Discovery Date 1948 1976 1938 1959 1927 1951 1968 1951 1965 1963 Total |

‘000 Barrels/Day 4,500 1,400 1,300 (?) 900 900 (?) 900 (?) 700 (?) 700 (?) 700 (?) 600 (?) 12,600 |

In reviewing this chart, you can see that we would have to discover an equivalent of 14 new giant oil fields the size of Ghawar to meet the expected future demand. There is no silver bullet of technology that will make up this difference in expected demand vs. supply.

Ownership of Reserves:

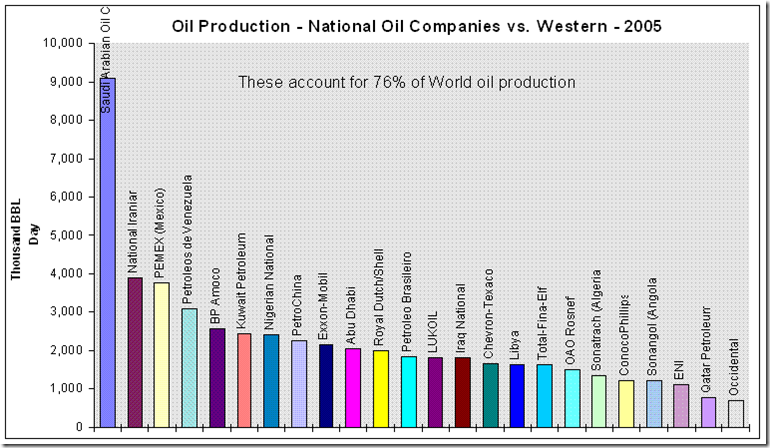

Who owns the oil in the ground? The following chart shows that National Oil Companies (NOC) own most of the production:

U.S. Oil companies account for less than 20% of world production. These companies do not have the ability to set prices. OPEC is the major supplier of world oil and has pricing power. Taxing U.S. oil companies for high prices produces no impact on pricing. Oil companies are currently buying reserves by buying back their own stock in a repurchase program. If there was a major probability in discovering huge reserves, they would be directing cash to those projects instead.

The Impact of Two Decades of Low Prices:

The last 20 years’ prices drastically reduced infrastructure investment and replacement. The pipeline infrastructure is made of steel and is rusting. This will force notable investment in infrastructure thus supporting high commodity prices. In the U.S. alone, oil and gas employment was reduced by 50%. The drilling rig count plummeted and rigs sat rusting away in fields. A small drilling rig costs in excess of $500 thousand to build. Oil field experience is at a multi-decade low. 50% of Exxon’s employees will be at retirement age in 5 years. Low prices caused a "brain drain". The IEA projects energy infrastructure cost to exceed $5 trillion for growth alone.

Alternative Energy- Ethanol

Ethanol is a poor substitute for oil. It is corrosive to the existing pipeline infrastructure. Its energy output versus energy required to refine it is low compared to oil. Ethanol requires a feedstock and fresh water. Both ingredients are in limited supply and are expected to be in shortage as well. The current primary feedstock is corn. Its price is at an all time high. Although we all support the farmers in their effort to generate a profit, ethanol will lose its support as the impact of production is understood by the politicians. Ethanol contains 84,100 BTUs per gallon and the replacement energy value for the other co-products is 27,579 BTUs. Thus, the total energy output is 111,679 BTUs and the net energy gain is 30,589 BTUs for an energy output-input ratio of 1.38:1. Oil ratio is much higher (8:1 to 23:1 depending on the logistics).

Alternative Energy- Wind

Wind is totally dependent upon geography and weather. Although it will supplement the power grid in some states, the economics do not support a major infrastructure investment to solve the energy demands of the upcoming crisis. Individuals living in windy areas might consider the use of wind to generate electricity. Major population areas will not benefit from this technology anytime soon.

Alternative Energy- Solar

Existing technologies will not support the growth of the electrical requirements of the U.S. Although a reasonable personal alternative for supplemental power, the solar solution will not be effective as a national solution.

Alternative Energy- Nuclear

Although 3 Mile Island reactor incident never caused a death, Americans have been afraid of nuclear power since. France generates over 70% of its power from nuclear power plants. Red tape and civil litigation contribute to 10 year construction cycles of new power plants. If the U.S. power companies were to start plans immediately for new nuclear plants, it would take 10 years to become operational.

Alternative Energy- Electric

There are approximately 170,000 service stations in the U.S. Building electric cars will necessitate a substantial infrastructure cost to ramp up service stations to handle increased recharging needs. This will take time. Early buyers of electric cars will be restricted in their driving range. Another issue is that our electrical grid is growing and outpacing power plant construction. Any additional burden on the grid will move it to a crisis sooner than later. The U.S. commercial infrastructure is heavily dependent on oil for energy and thus the impact of electric cars would be minor for 15-20 years. The U.S. has a 17 year inventory turnover rate of vehicles. It would take at least 8 1/2 years to replace half of the country’s fleet if electric cars were available and could meet the transportation requirements of the population.

Alternative Energy- Coal

Coal is an abundant resource in the U.S. However, the "green" direction of the U.S. will prevent new coal plants from being built. New coal plant construction has been denied in several states. Instead, natural gas plants are being considered as an alternative. These plants will generate electricity at a higher cost versus coal. Green is in, coal is out!

A comparison to oil:

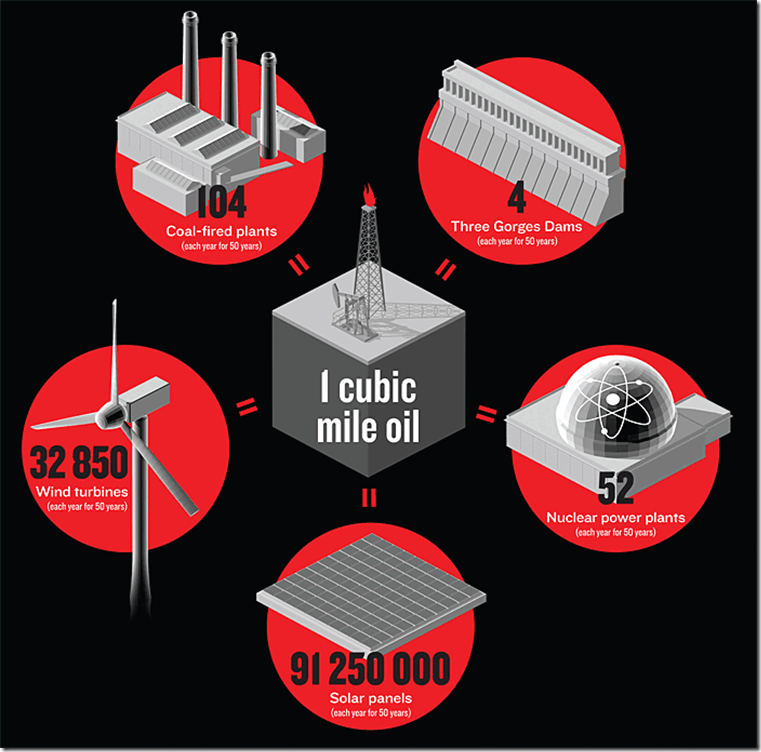

To obtain in one year the amount of energy contained in one cubic mile of oil, each year for 50 years we would need to have produced the numbers of dams, nuclear power plants, coal plants, windmills, or solar panels shown below:

Summary

The energy crisis is here. There is no alternative that could be developed in time to avert this crisis. Wars have been fought over resources throughout history. Unless we have a Divinely appointed intervention, energy prices will skyrocket and will support a global depression. The response to the Great Depression of the 1930’s was a World War. The NOC’S have no incentive to sell their inventory at lower prices. In fact, their incentive is to slow production and receive a higher price for their product. U.S. oil companies will enjoy the profits but have no ability to determine price. Investing in well run energy companies will be the best defense against rising prices at the gas pump. "You might as well buy the product from yourself."