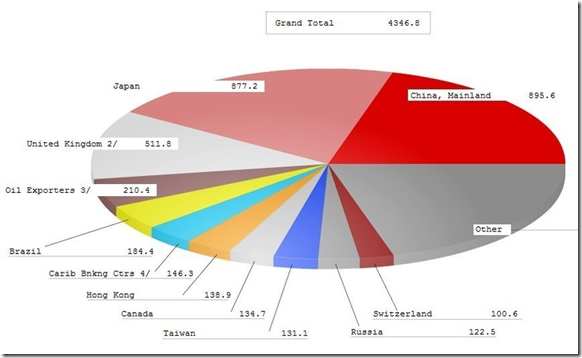

The above chart provides us a view of who buys our debt. The top two creditors have been China and Japan and both have separate reasons for reducing their holdings. First, Japan’s recent disaster will cause them to focus their economic power in rebuilding and restarting their economy. Secondly, China has been reducing their holdings because of the U.S. spending like a drunken sailor who just entered port (my apologies to the drunken sailor).

Who then will buy our debt? Ben Bernanke and the Federal Reserve. Where will they get the money? They will create it out of thin air. Sweet! What will it do to yours and my money? It will instantly devalue it. Not so sweet. The additional problem is that all of those creditors in the above chart will also have their holdings reduced in value. With interest rates in the basement, their U.S. Dollar holdings don’t keep up with core inflation.

What will be the result of all this? Either bond interest rates must go up thus further devaluing the current bond values and causing the U.S. deficit to increase in order to pay the additional interest cost, or the Federal Reserve must buy more debt with “funny money”. This situation is the tightrope those in power are walking. There is no apparent scenario without pain. Bill Gross of PEMCO, the largest bond fund in America, recently reduced his holdings of U.S. debt. He may be the canary in the mineshaft.

The earthquake and resulting tsunami in Japan may be the economic tipping point that shows up later this year. Be vigilant.