By now all of us should agree the U.S. Government’s reported core inflation number is bogus. I guess that those who calculate inflation do not go to the grocery store or drive a car. In this writing I want to look at the area of "personal financial destruction" of savers. My parents were savers. They instilled the need to save money in my brother and me. At a young age we both had a savings account. I did a poor, no a pathetic job of saving back then. I learned the mechanics but had no understanding. As all other kids, I was a consumer not a saver. However, once I married the understanding kicked in… This was serious stuff! Back then we were told to have six months’ income in savings in case of an emergency. That number soon changed to twelve months. That savings account was left untouched. In the 1970’s passbook savings accounts paid 5 – 5 1/2% interest. That was the firm base level. C.D.’s paid higher rates, a premium for the inaccessibility of your cash (illiquidity). In the late 1970’s inflation raised its ugly head. C.D. rates shot strait up. Treasury Bill rates followed. 12-15% return on your money was not unusual because you were paid 2-5% over the rate of inflation. Your money was protected from the rages of inflation. That was then.

We now are in a different paradigm. Back then bankers were prudent, now they are reckless. Back then there were no hedge funds who could borrow from the banks at 30 to 1 ratios. Back then there was not over 1 quadrillion dollars in derivatives. Back then you could not buy house unless you had good credit and a substantial down-payment. Back then there were no 72 month car loans. Back then you could only have one credit card, if you were fortunate. I was turned down in 1973 when I applied for a credit card with a $300 credit limit, and I worked at the bank who denied it!!! Back then there were twice as many banks as there are now. Back then there were three drug stores in the community of 50,000. Back then we worked on our own cars, the auto mechanic didn’t know what a computer was?

Inflation is at 6% (at least). Savings rates are at 1 to 3.5%. We are now in the destruction phase of the value of the dollar. What does it mean to you and me? Let me show you. The following table calculates the five year results of saving:

Interest Income Scenario

| |

Beginning of Year |

Annual Interest Rate |

Annual Profit |

Value at End of Year |

| 2009 |

1,000.00 |

3.50% |

35.00 |

1,035.00 |

| 2010 |

1,035.00 |

3.50% |

36.23 |

1,071.23 |

| 2011 |

1,071.23 |

3.50% |

37.49 |

1,108.72 |

| 2012 |

1,108.72 |

3.50% |

38.81 |

1,147.52 |

| 2013 |

1,147.52 |

3.50% |

40.16 |

1,187.69 |

Ok, you made a total of 187.69 on your money over the next five years. What happened to that value of your original investment in purchasing power? The next table reveals the destruction of your wealth:

Inflation Devaluation

| |

Beginning of Year |

Annual Interest Rate |

Annual Loss |

Value at End of Year |

| 2009 |

1,000.00 |

6.00% |

60.00 |

940.00 |

| 2010 |

940.00 |

6.00% |

56.40 |

883.60 |

| 2011 |

883.60 |

6.00% |

53.02 |

830.60 |

| 2012 |

830.58 |

6.00% |

49.84 |

780.75 |

| 2013 |

780.75 |

6.00% |

46.84 |

733.90 |

Over the next five years, you will probably lose about $270 purchasing power for every $1,000 you possess. Some assets will go up in value, others will not. Housing prices will probably revert back to their long term appreciation curve at best. All the recent gains may be wiped out.

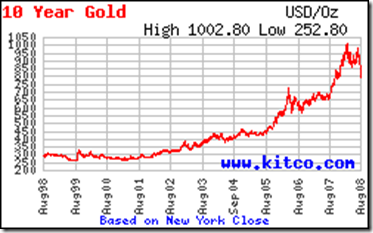

The commodities are in a long term bull market and the dollar is in decline. Therefore, the challenge is to invest in something that increases in value faster than the inflation rate. I continue to believe gold, silver, oil & gas are those investments. The following table represents what I believe is the conservative endgame.

Gold Appreciation against the U.S. Dollar

| |

Beginning of Year |

Annual Interest Rate |

Annual Profit |

Value at End of Year |

| 2009 |

1,000.00 |

18.00% |

180.00 |

1,180.00 |

| 2010 |

1,180.00 |

18.00% |

212.40 |

1,392.40 |

| 2011 |

1,392.40 |

18.00% |

250.63 |

1,643.03 |

| 2012 |

1,643.03 |

18.00% |

295.75 |

1,938.78 |

| 2013 |

1,938.78 |

18.00% |

348.98 |

2,287.76 |

Make no mistake that there will be dramatic volatility as the prices of commodities ascend. Why? Let me explain. The fiat money system is a house of cards. There is nothing except perception to back up the value of the U.S. Dollar. The central bank (Fed) can print as much money as they desire. There is no asset backing the printing. If you or I did this, it would be fraud. They are increasing the money supply by double digits. That is purely inflationary. Other countries’ currency have appreciated against the dollar. It is more expensive to stay in a hotel room in Europe that it was one year ago. If you are an American, that is inflation. Other developed countries have seen oil price increases but not to the same degree. There are so many factors favoring the safe haven of hard assets yet there is so much "noise" emanating from the powers that be. Our challenge is to keep our heads when all about us are losing theirs. Consider the following:

1. US banks (commercial or investment) have purposely withheld their true profitability or losses and will not have to report off balance sheet losses for at least another 12 months.

2. Auction Rate Bonds which are estimated at between $400 to $500 Billion have now surfaced as the latest financial instrument of mass destruction. The Fed will have to support the same institutions that are already at the Fed Loan window.

3. High powered computers and savvy traders with a lot of backing are manipulating the technical views of Wall Street. That is well known. If you need to manipulate the market, there is something seriously wrong.

4. Major retirement funds will not regain the value that has been stripped away by all forms of SIV’S (Securitized Investment Vehicles). All those people who worked their entire career in a "safe" job may not have such a safe retirement.

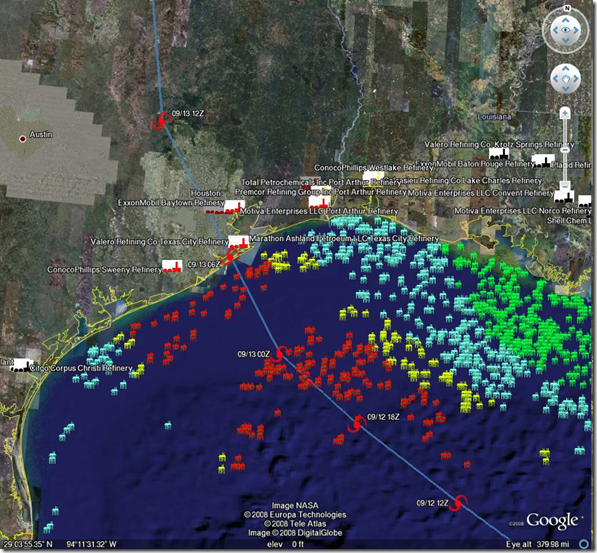

5. Energy is not in a global demand destruction, Asia keeps growing at a high economic rate. They will be happy to consume our decrease in oil consumption.

6. China’s economy will not collapse after the Olympics are over. China’s backlog will force much overtime.

7. Europe’s economic situation is not as severe as the USA’s. Their infrastructure is better equipped for high energy prices. They already have local gardening plots and are more prepared to deal with expensive energy than the U.S.

8. Gold has no liability attached to it and is a better storehouse of value than any fiat currency that has large and incalculable liabilities against it.

9. OTC derivative problems have not ended. That is why the Fed is loaning our children’s money to the banks and not requiring full disclosure of all losses.

10. The credit market is not loosening up but contracting in a full defensive and survival footing.

11. Insurers who insure (guarantee) the value of debt instruments do not have enough money to make good as bankruptcies increase.

12. Central banks have been diversifying out of the US dollar. What do they know that we don’t?

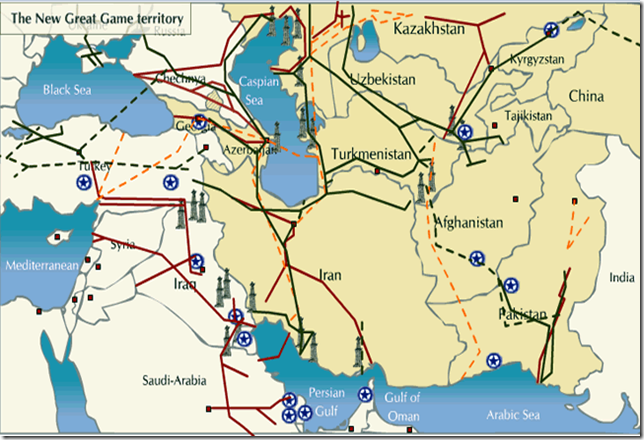

13. Israel will not permit Iran to reach that point where it can nuke their country. Another war in the area is bullish for hard assets.

14. Pakistan is a time bomb ticking away. Can the U.S. be involved in another front?

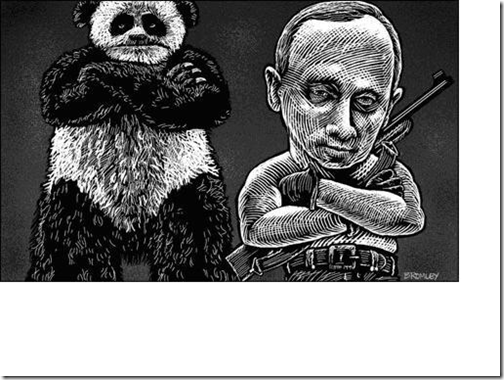

15. Russia’s Putin has the resources to begin taking back satellite countries it lost during that last breakup. With oil and gas revenues, he has a war chest to challenge the current powers. He holds Europe by the "privates" since Russia provides much of the energy used by Europe. Georgia’s pipeline may be renamed to the "Putin Trans-Soviet" pipeline.

Are we at a paradigm shift? I think so and I am putting my money where my mouth is. The central banks can toy with the value of the dollar on a short term basis but the market is bigger than the central banks. When people see that their financial well being is threatened, they will flee to gold as they have done for thousands of years. At that flashpoint, you will see a parabolic rise in the price of gold and silver. In the meantime, don’t let the central banks pry your investment out of your fingers. These are the people who have moved and kept the interest rates below the rate of inflation and you can bet they know what they are doing to us who are savers!